Key Insights

- According to Sebastian Bea in a recent interview, the US has what it takes to purchase billions of dollars in Bitcoin without increasing national debt.

- The main idea of Bea’s argument sits around how the U.S. currently values its gold reserves.

- Presently, the U.S. Treasury lists its holdings at $42.22 per ounce, which is a price that hasn’t been updated since 1973.

- Meanwhile, gold trades on the open market at over $3,300 per ounce.

- The US can now simply update its laws, and specifically amend its 31 U.S.C. § 5117 legislations to purchase nearly a million BTC.

The idea of the U.S. government buying Bitcoin would have sounded like a stretch ten or even five years ago.

However, according to Sebastian Bea, President of Coinbase Asset Management in a recent interview, this is very much a realistic scenario that could become reality sooner than expected.

Bea believes that a change in how the U.S. accounts for its gold reserves could be what it takes to unlock the funds to do so.

These funds will allow the government to invest up to $100 billion in Bitcoin without even having to raise the national debt or print more money.

This prediction comes at a time when Bitcoin is already in the middle of a surge back to its $109,000 all-time high and is retesting $96,000.

Market momentum and institutional interest are heating up, and Bea’s plan may not be as far-fetched as it once seemed.

Revaluing Gold As A Financial Breakthrough

The main idea of Bea’s argument centers around how the U.S. currently values its gold reserves.

Presently, the U.S. Treasury lists its holdings at $42.22 per ounce, which is a price that hasn’t been updated since 1973.

Meanwhile, gold trades on the open market at over $3,300 per ounce.

This massive difference in prices now has what it takes to open a hidden value of nearly $900 billion that now sits in the government’s balance sheet, waiting to be tapped.

The US can now simply update its laws and specifically amend its 31 U.S.C. § 5117 legislation.

As such, it can revalue its gold to reflect the current market price and allow the Treasury to issue high-value gold certificates.

This would create new financial room without the US having to take on new debt.

The Push Towards The Bitcoin Investment

Bea’s strategy sits well in line with Senator Cynthia Lummis’s proposed BITCOIN Act, which calls for the U.S. Treasury to purchase one million Bitcoin over the next five years.

The bill features a framework for how such a crypto investment could come to light without negatively affecting the federal deficit.

If passed, this bill would represent an estimated 5.5% of Bitcoin’s total market cap. Not only would this send shockwaves through every financial market, it would also create a precedent that other nations might feel pressured to follow.

This could be great news for investors, especially for the world today, where digital assets are becoming more and more important.

The U.S. taking a leadership role in this space could be just the boost that Bitcoin and the altcoins need.

Could This Happen This Year?

Bea outlook isn’t tied to a specific timeline. However, he believes that 2025 could be the year when everything lines up politically.

It all depends on whether Congress is willing to take the necessary steps needed to unlock the value of the country’s gold reserves.

The timing may be perfect, as it stands.

As of May 1, 2025, Bitcoin has already soared to $96,000 and is now more attractive than ever to institutional investors.

A U.S. entry into the market at this stage could serve as a a much needed catalyst and push Bitcoin past the $100,000 mark once again.

What’s Fueling the Rally?

Bitcoin’s price surge isn’t just speculative hype. The price jumped 8.2% in the last 24 hours, after rising from $88,500 to $96,000.

Trading volumes also exploded, with over $45 billion in transactions between 9:00 AM and 11:00 AM UTC across major exchanges like Binance and Coinbase.

This 35% increase in volume shows that participation is on the rise from both retail and institutional players.

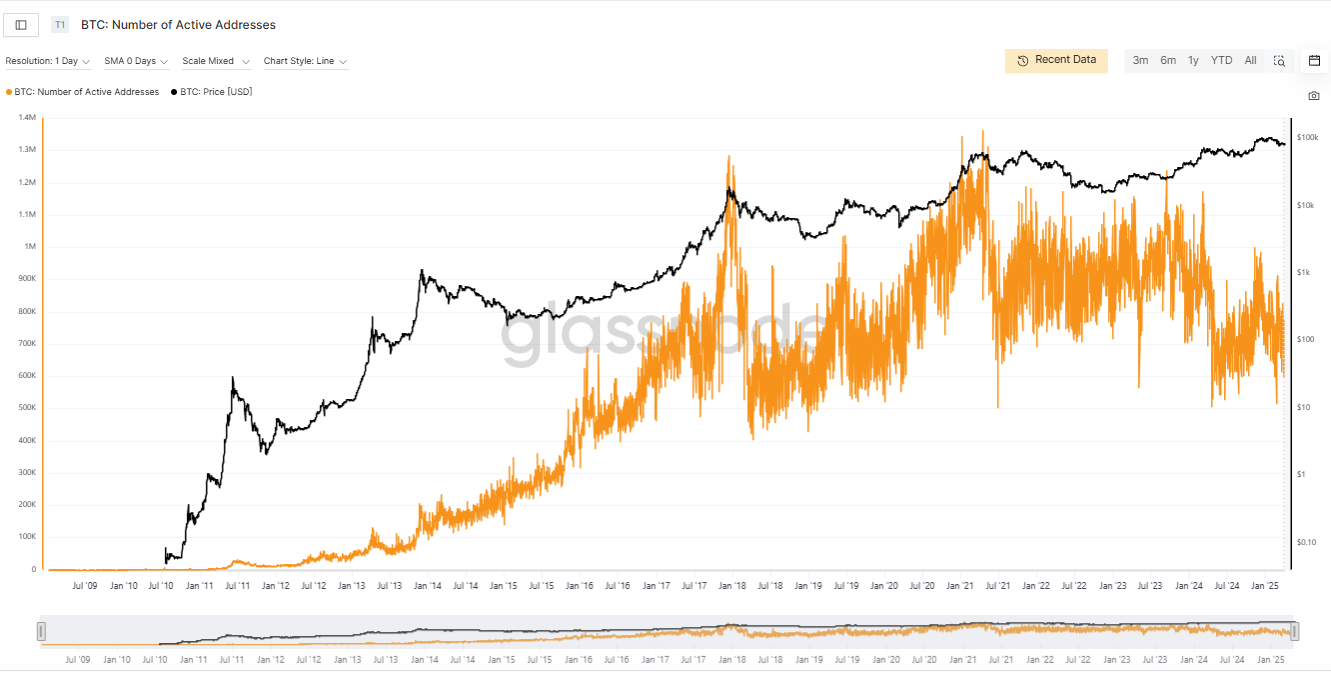

On-chain data is also in support of this, as Glassnode reported 1.2 million active Bitcoin addresses on May 1.

This stands as a 20% increase from the day before.

On the other hand, Bitcoin’s hash rate hit a new all-time high of 650 EH/s, in an indicator that the miners are gaining strength.

Overall, these technical indicators show that the market is not only bullish but also strong from a fundamental standpoint.

AI Trading Bots and the Rise of Smart Money

One more interesting trend in this price surge is the influence of AI in crypto trading. According to CryptoQuant, AI-driven bots accounted for around 15% of Bitcoin’s trading volume on Binance during the most active hours.

These algorithms have become top participants in the market and are driving both volume and volatility so far.

The ripple effect of this move has expanded into AI-related tokens like Fetch.ai (FET) and SingularityNET (AGIX), both of which saw price jumps of 12% and 9%, respectively, according to data from CoinMarketCap.

Uniswap data shows that the trading volumes for AI tokens spiked by 22% to a new high of around $1.1 billion between 10:00 AM and 12:00 PM UTC.

This crossover between AI and crypto is gaining attention from traders who are looking for high-growth opportunities.

Support, Resistance and What’s Next

From a trading perspective, Bitcoin is now testing major price levels, with the $96,000 mark serving as a major resistance resistance.

As expected, there is some psychological pressure around the $100,000 price level, and the major support levels to watch out for include $93,500 and $92,000.

So far, technical indicators show that the rally still has some steam to it.

For example, the Relative Strength Index (RSI) sits at 78 on the 4-hour chart, in a show of both overbought conditions and strong bullish momentum.

Moreover, the MACD confirmed a bullish crossover on 1 May, which means that the upward move is further validated.

How a U.S. Bitcoin Investment Could Affect The Market

If the U.S. government follows through on Bea’s strategy, it would be a major turning point, not only for the crypto space but also for sovereign investment.

The creation of a Bitcoin-backed sovereign wealth fund would further push Bitcoin forward on a scale never seen before.

It would increase global competition for the asset and pressure other countries to diversify their reserves into crypto.

Institutional interest in Bitcoin is already growing, especially with its increasing volumes, increased miner activity and AI trading bots now in the mix.

A $100 billion investment by the U.S. would not just be something for the headlines.

It would be nothing short of transformational for the asset.