Key Insights

- President Donald Trump has openly called for the removal of Federal Reserve Chair Jerome Powell.

- Although Trump nominated Powell to lead the Federal Reserve in the first place back in 2017, their relationship has quickly soured over the years.

- He said via a Truth Social post, “Powell’s termination cannot come fast enough!”

- The Federal Reserve was created to be an independent agency. This means that it is immune to any kind of political influence.

- Trump cannot remove Powell according to the US Constitution.

- According to Georgetown law professor Stephen Vladeck, if Trump were to somehow pull this off, it could “undermine the independence of the Fed.”

This week has taken an interesting turn so far, with President Donald Trump openly calling for the removal of Federal Reserve Chair Jerome Powell.

This development has re-stoked the fires of a long-standing feud and is raising heavy questions in the legal and economic scenes.

Can a sitting US president actually fire the head of the Federal Reserve?

Trump seems to believe that he can, and Powell, on the other hand, isn’t so sure.

Here’s a breakdown of the face-off and what could happen next.

The Trump vs. Powell Battle

The tension between Trump and Powell didn’t just begin this week. Although Trump was the one who nominated Powell to lead the Federal Reserve in the first place back in 2017, their relationship has quickly soured over the years.

The last few years have seen Trump repeatedly criticize Powell, mostly for his decisions when it comes to monetary policy.

The president seems to favor lower interest rates, which have proven to be good for economic growth.

Lower interest rates have also been politically popular over the years, especially in election cycles.

However, Powell, on the other hand, is more cautious. The last few years have seen the FED chair raise rates when inflation rises and opt to keep them high to hold the economy stable.

17 April, however, saw Trump reignite his feud with the FED via a Truth Social post, in which he said “Powell’s termination cannot come fast enough!”

He doubled down on this stance later on in a press conference, saying, “If I ask him to, he’ll be out of there… and if I want him out, he’ll be out of there real fast, believe me.”

Trump’s statements therefore beg the question:

Can President fire the Fed Chair?

Legally speaking, the answer to this question isn’t a simple yes or no.

The Federal Reserve was created to be an independent agency. This means that it is immune to any kind of political influence.

This independence is what helps the agency to properly perform its functions in financial markets around the world.

One major piece of legal precedent to keep in mind is the 1935 Supreme Court case Humphrey’s Executor v. United States.

According to this ruling, a sitting president (or otherwise) cannot remove officials from independent agencies simply because of disagreements on policy.

While the Federal Reserve wasn’t mentioned specifically in this case, it falls under this umbrella and is therefore protected.

Despite this, Trump has taken some serious steps in his second term by removing officials from other independent agencies like the Federal Trade Commission, the National Labor Relations Board, and the Merit Systems Protection Board.

This string of removals could be setting the stage for a real showdown in court soon.

According to Georgetown law professor Stephen Vladeck in an interview with SCOTUSblog, if Trump were to somehow overturn the Humphrey Executor, it could “undermine the independence of the Fed.”

Even worse, it could destabilize the economy.

So Why Does Trump Want Powell Out?

While Powell’s decisions to keep interest rates high help to control inflation, they do raise borrowing costs.

When borrowing costs go up, fewer people naturally want to take out loans.

Investor appetites tend to crash, and stocks (not to mention crypto) tend to suffer. While such a policy helps to control inflation, it slows economic activity down, which is what Trump might find frustrating.

He believes that Powell is acting too slowly in adjusting rates and has labeled the FED chair repeatedly as “TOO LATE AND WRONG.”

Trump argues that if Powell had lowered rates earlier, the U.S. economy would be stronger now.

There are also other issues with this conundrum.

For example, Trump has openly suggested that the president should have a say in setting interest rates.

He said in August of last year that he has “made a lot of money,” and therefore has “better instinct than, in many cases, people that would be on the Federal Reserve or the chairman.”

Powell Responds

Jerome Powell has mostly remained silent despite Trump’s barrage of attacks.

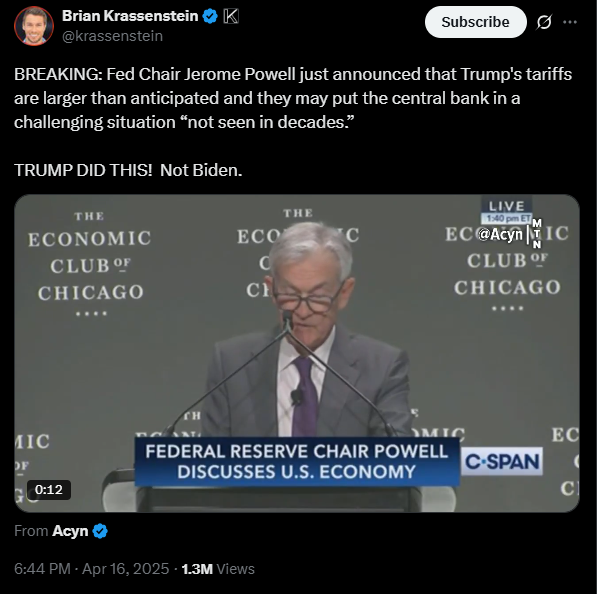

However, he did respond recently to the latest developments during a recent appearance at the Economic Club of Chicago.

When asked about how possible it was to get fired, Powell said he wasn’t sure whether the recent court decisions or any of the other agency firings would apply to the FED.

However, he pointed out that the Fed’s independence is “very widely understood and supported in Washington and in Congress, where it really matters.”

Powell’s tenure is set to expire by May 2026. Until then, he seems determined to stay the course.

What’s at Stake?

The implications of removing the FED chair would be very serious indeed.

According to reports, Treasury Secretary Scott Bessent warned Trump that such a move could destabilize the financial markets, which is the same warning that Vladeck issued.

Senator Elizabeth Warren has also echoed this concern in an interview with CNBC, in which she mentioned that removing Powell would “crash markets in the United States.”

The Federal Reserve plays a major role in the US economy by managing inflation and stabilizing prices.

Its independence allows it to make some difficult but necessary decisions without pressure from the US government.

If the White House begins to interfere with these decisions, investor confidence in the U.S. economy could be shaken.

The market itself relies on the idea that the FED itself operates based on economic data, not political demands.

If word gets out that the US president somehow controls the financial markets, it would undermine that belief and lead to uncertainty, which is something investors hate.

What Happens Next?

Trump has reportedly been floating the idea of not only removing Powell but also replacing him with former Fed Governor Kevin Warsh.

Warsh, on the other hand, has advised against firing Powell, noting that such a controversial move would be a problem, even among Trump’s allies.

Looking ahead, the White House plans to begin interviewing candidates for Powell’s replacement this fall.

Whether or not Trump follows through on firing Powell, the suggestion alone is already stirring the pot of tension in the financial markets.