Key Insights

- President Trump has just signed the first crypto-specific bill into law and has just repealed the IRS DeFi Broker Rule.

- The rule would have required DeFi platforms to report user data the same way as traditional brokers.

- The most recent bill has seen strong bipartisan support and is being celebrated across the crypto industry.

- While this was happening, the SEC provided new guidance and dropped several other high-profile lawsuits.

- The repeal marks a major shift in how the U.S. aims to approach crypto regulation going forward.

The crypto industry has just hit a major milestone.

According to recent updates, US President Donald Trump has just signed the first-ever US crypto-specific bill into law.

This new law reverses the controversial IRS DeFi broker rule, which was introduced during the final months of the Biden administration.

Said rule sought to impose traditional broker-level tax reporting on DeFi platforms.

Here’s why this points towards a major change in U.S. crypto policy and also shows that the Federal Government is starting to embrace crypto with more support.

A Landmark Bill with Bipartisan Support

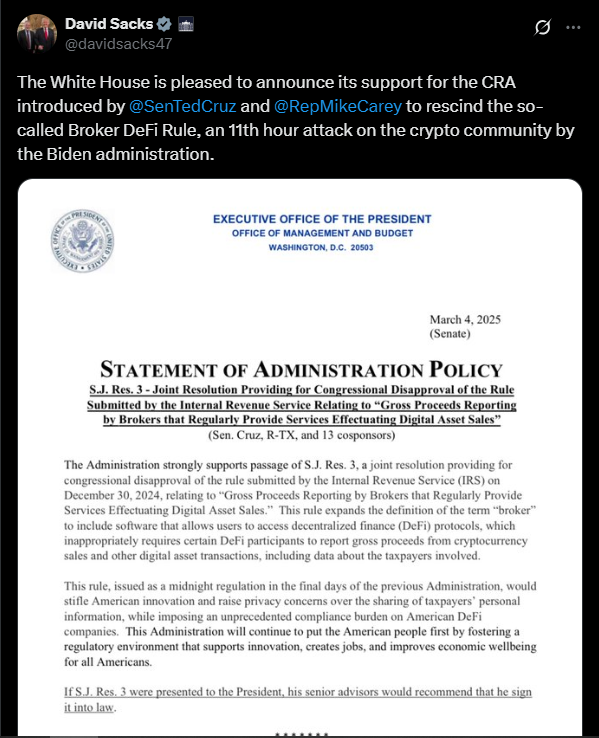

The bill in question was passed under the Congressional Review Act (CRA).

It was cleared in both chambers of Congress with a great deal of bipartisan backing (70-28 in the Senate and 292-132 in the House).

This IRS DeFi broker rule reversal was co-authored by Senator Ted Cruz and Representative Mike Carey (R-Ohio).

In a speech at the signing ceremony, Rep. Carey pointed out the wide-reaching impact of the repeal.

He called it the “first cryptocurrency law ever passed in the United States” and “the first CRA related to taxes to be enacted.”

So What Was the IRS DeFi Broker Rule?

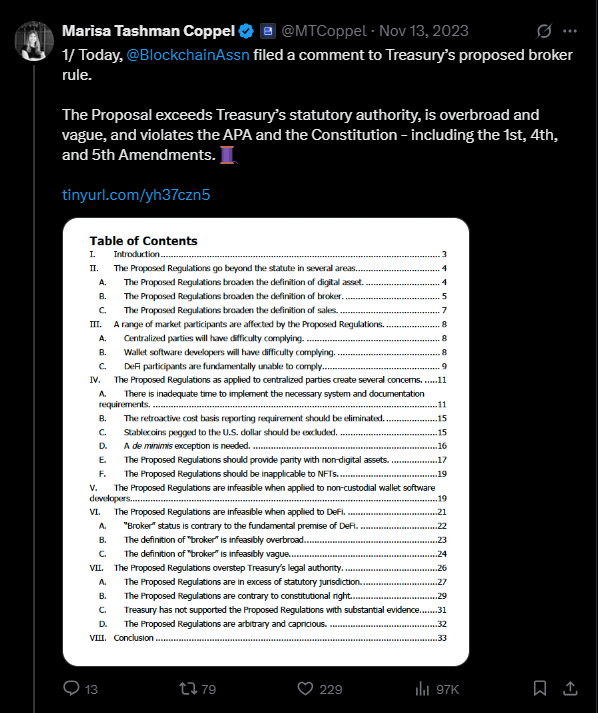

The IRS rule was finalized early last year and was an extension of previous tax laws.

Said laws would have required DeFi protocols to collect and report detailed transaction data from their users, standing against everything that DeFi represents in terms of decentralization.

Put simply, it was aimed at treating these platforms like traditional financial brokers.

Critics, including industry leaders and other pro-crypto lawmakers, argued that the rule was unreasonable.

Since DeFi platforms operate autonomously via smart contracts (and therefore have no central authority), fulfilling the requirements demanded by the rule would be practically impossible.

Moreover, critics feared that such a law would stifle innovation and infringe on user privacy.

This is without mentioning how it would flood the IRS with unnecessary filings that the agency simply cannot process.

According to Executive Director of the President’s Council of Advisers on Digital Assets Bo Hines, the recent repeal of the law has been a “huge moment” for crypto.

He stated on X (formerly Twitter) that the move is a great step towards “protecting innovation and privacy”.

In addition, it also marks “another big step towards the golden age for digital assets.”

Trump Administration’s Pro-Crypto Stance

The Trump administration has been very open towards crypto since taking office in January of this year.

Recall that the White House’s AI and crypto adviser, David Sacks, previously bashed the IRS DeFi rule as an “11th hour attack” from the Biden era.

Sacks described it as both damaging to the US’ ability to compete and “fundamentally flawed” in relation to how decentralized systems work.

By signing this bill, Trump has made history and also sent a clear message to the rest of the world.

The US is emerging as one of the most supportive governments towards the crypto space.

More Regulatory Changes at the SEC

The repeal of the IRS rule comes alongside other favorable developments in the crypto space and within the SEC.

For example, the SEC released updated guidance on how securities laws apply to crypto assets on the same day that Trump signed the bill.

The new guidelines from the SEC are aimed at clarifying disclosure requirements for companies issuing or registering crypto assets.

Some of the featured topics include price volatility and legal uncertainties, alongside technological risks.

While the agency has stopped short of offering complete regulatory relief, the updated guidelines show a more structured path ahead.

Alongside all of the above, the SEC has also dismissed its charges against Nova Labs, the developer of the Helium Network.

The agency has effectively removed its securities classifications from tokens like HNT, MOBILE and IOT with this move.

Ripple, the issues of XRP have also been recipients of this regulatory shift so far, after the departure of former chair Gary Gensler earlier this year.

Helium celebrated its legal victory on Twitter, stating that “With this chapter finally closed, Helium and crypto can now move forward.”

What This Means for Crypto in the U.S.?

This crypto law repeal shows a major shift in tone from the US, the IRS and the SEC in a major turning point for the crypto industry in the US.

Prior to this, regulatory uncertainty and overreach had chased many crypto start-ups out of the US.

However, federal agencies are now reevaluating their approach to the matter, and the president is showing increased support.

The US is now closer to its goals of being a global leader when it comes to blockchain growth.

The repeal has also eased tensions among DeFi developers who faced hurdles with compliance that would have made their platforms hard to use (or operate) in the U.S.

Without the threat of reporting on their users like traditional brokers, DeFi protocols can now focus on innovation within the country.

A Sign of Things to Come?

While this is just one out of many other legal actions that need to be put in place, it does set the ball rolling.

Crypto advocates hope that the most recent update will create a path towards more thoughtful regulation within and outside the US.

The crypto space needs more rules that protect consumers without stifling innovation.

President Trump’s signing this bill marks the first time that a sitting US president has made crypto regulation a priority in lawmaking.

It sends a major message to the rest of the world that the US is ready to become a major supporter of crypto.

If the momentum continues, this could be the beginning of a more welcoming relationship between Washington and Web3.