Key Insights

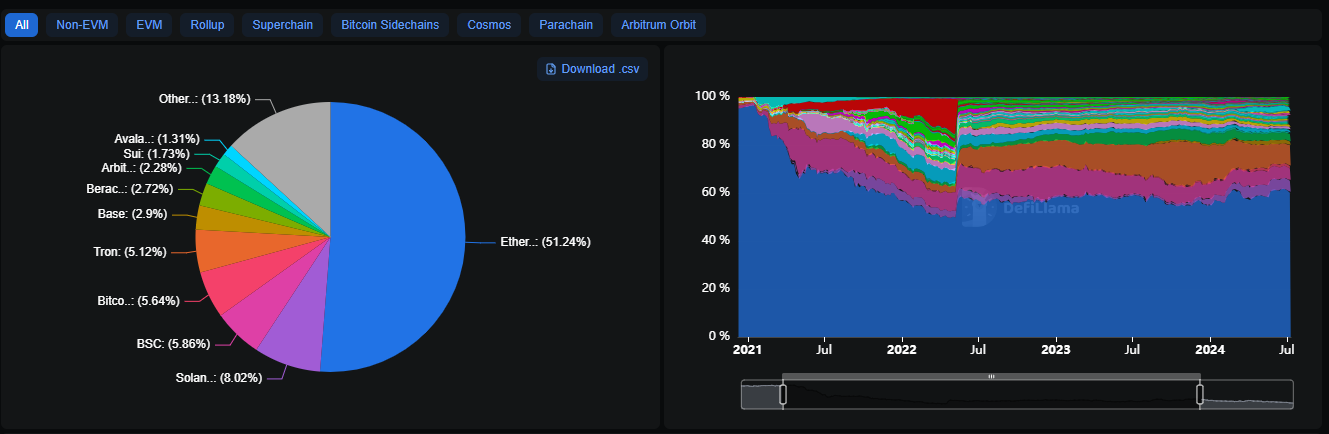

- According to data from DefiLlama, DEX volumes for the Solana network crossed the $50.7 billion mark in April alone.

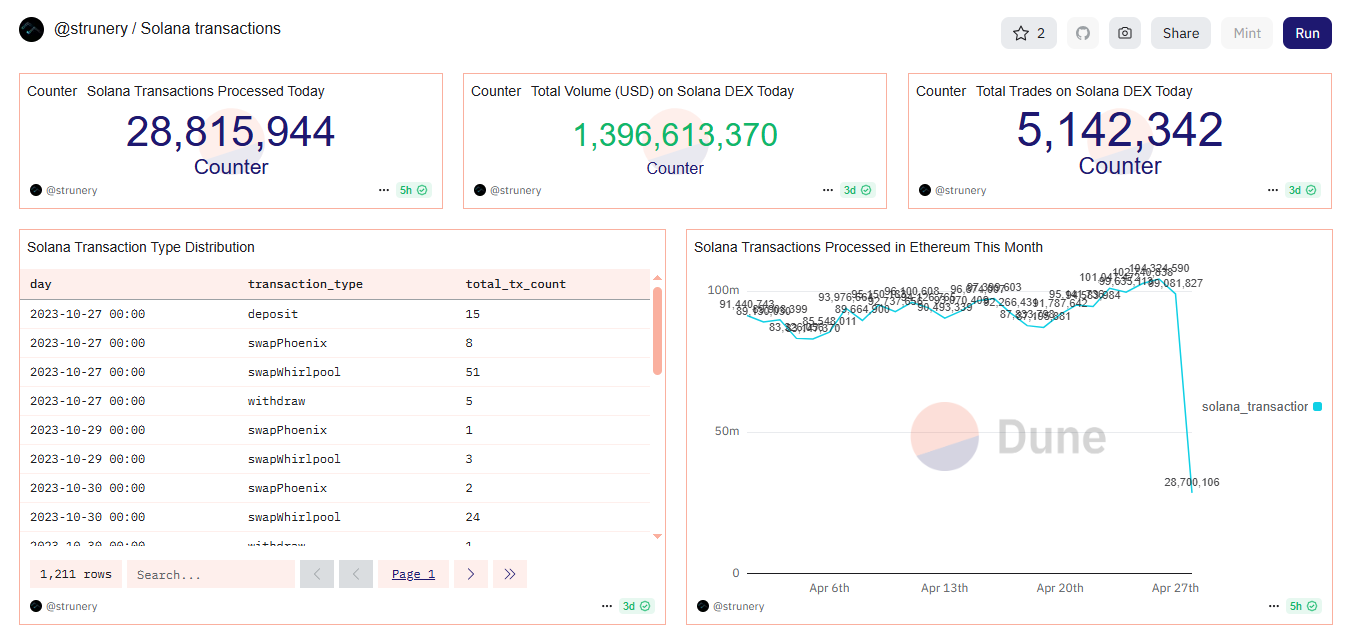

- The Solana network recorded 31.39 million – 35.2 million transactions daily and had nearly 30 times the transaction count of Ethereum for April.

- The funding rates have even turned positive, with the spike in open interest that shows that volatility could increase.

- While this is happening Solana still lags heavily behind Ethereum in Total Value Locked (TVL) and stablecoin liquidity.

- Institutions are becoming interested because in April alone, the sector saw over $1 billion in new investment capital for Solana initiatives.

The crypto space is heating up once again, and the battle for dominance among the biggest players continues to rage.

So far, the toughest of these battles has been between Ethereum and Solana, with data from the first quarter of the year showing that Solana is outperforming Ethereum in DEX volumes.

April is winding down, and momentum remains firmly in Solana’s favor.

However, the story doesn’t end there. The rise of Solana shows a major shift across the crypto and defi spaces, and these shifts could extend further into the rest of the year.

Solana Outperforms Ethereum in DEX Volumes

Solana’s strength, especially in terms of decentralized exchange volumes, tell a clear story.

According to data from DefiLlama, DEX volumes for the Solana network crossed the $50.7 billion mark in April alone.

This is a major achievement for Solana, especially considering Ethereum’s recent efforts to reclaim its lead after registering a mere $39.6 billion.

While Ethereum-based projects like Berachain and Sonic have been performing well as of late.

However, this hasn’t been enough to topple Solana.

The increase in DEX volume is also interesting, in that it dispels concerns that Solana’s strength is based only on memecoin speculation.

The DEX volumes show that the Solana ecosystem is thriving across multiple sectors.

Transaction Volumes Show Even Bigger Gaps

More than DEX activity, Solana’s transaction count show an even higher contrast.

According to data from Dune Analytics, Ethereum’s daily transaction count currently hovers between 1.03 million and 1.33 million as a daily average.

On the other hand, the Solana network recorded between 31.39 million and 35.2 million transactions daily. This means that Solana had nearly 30 times the transaction count of Ethereum.

This wide difference shows that Solana isn’t just winning in trade volumes, it is also capturing real on-chain usage.

More transactions means that more users are active on the network.

It is therefore no surprise that Solana’s recent price performance has been beating Ethereum’s over the past few weeks.

Still Trailing in TVL and Stablecoin Liquidity

While this is happening Solana still lags heavily behind Ethereum in Total Value Locked (TVL) and stablecoin liquidity.

At the time of writing, Solana still holds around $9.57 billion in TVL compared to Ethereum’s $54 billion.

This means that Ethereum is leading Solana by nearly 6 times in terms of TVL.

On the other hand, stablecoin liquidity on Solana stands at $13.12 billion, while Ethereum’s stablecoin market cap is roughly nine times larger.

This isn’t necessarily a lead against Solana. Ethereum simply had an earlier start and was therefore the dominant smart contract platform for years before Solana was even created.

If anything, the gap leaves some room for Solana to grow, especially with the growing adoption from major players in the defi space.

Solana’s Price Recovery

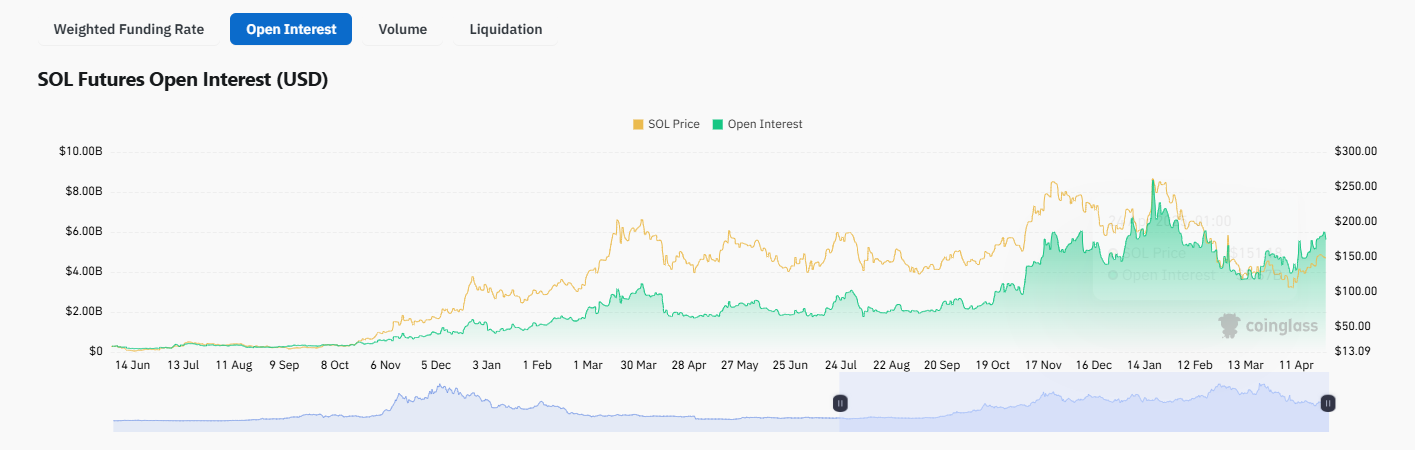

The $SOL cryptocurrency has seen a major comeback in April, from its lows earlier in the month.

The cryptocurrency has rallied by more than 64% so far, and hit a peak of $157 before pulling back slightly to $148.73 at the time of writing.

While this rally has been impressive, it is showing signs of exhaustion.

Demand has cooled off slightly over the last week, but sell pressure is still relatively weak.

This means that many holders are staying put and are possibly betting on further gains as the market’s conditions improve.

The derivatives market also show that volumes on SOL have been surging lately, alongside a near-12% increase in open interest.

The funding rates have even turned positive, with the spike in open interest that shows that volatility could increase.

With all of this being said, sharp increases in either direction are possible.

Institutions Are Betting Big on Solana

More encouraging signs for Solana’s future go deeper than mere user adoption.

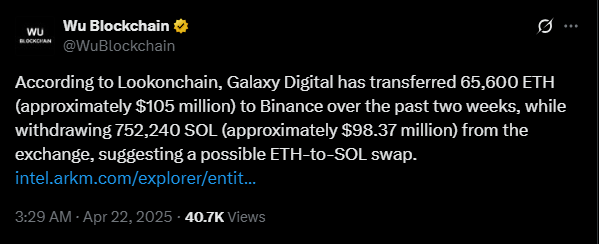

Institutions are becoming more and more interested in the cryptocurrency, because in April alone, the sector saw over $1 billion in new investment capital for Solana initiatives.

For example, GSR made a $100 million bet on UPEXI’s Solana-focused treasury shift within the month.

Alongside this, Astra Fintech launched a new fund aimed at early-stage Solana projects, while Mike Novogratz’s Galaxy Digital, swapped $100 million worth of Ethereum for Solana tokens on Binance.

Other major moves include purchases from ATW Partners, which committed up to $500 million to Solana-focused strategies, as well as the $125 million fund from RockawayX, specifically for Solana developers.

This wave of institutional support shows growing confidence in Solana’s long-term future.

What These Investments Mean for Solana’s Future

Unlike earlier phases of crypto hype where money chased ideas that were still on whiteboards, today’s investments are targeting real infrastructure.

Solana’s speed, low fees, community and scalability make it a major platform for defi and other applications.

Projects like Helium’s partnership with AT&T to build decentralized wireless networks on Solana show that the blockchain has promise beyond finance.

Real-world use cases are expanding and massive capital is flowing in to support development.

So far, Solana is building a system that could genuinely challenge Ethereum’s dominance over time.

While April was a month of victories for Solana, May will be even more important.

If Solana can maintain its transaction dominance, keep DEX volumes high and solidify institutional backing, it could enter a major bull phase.

If not, it risks slipping back into bearish territory with the rest of the market.