Key Insights

- Last year saw Solana ride the speculation wave better than any other network.

- This speculative frenzy that lasted for more than a year pushed Solana’s DEX volumes and transactions to record highs.

- Despite the decline, Solana (SOL) is still leading, with March seeing Solana DApps account for up to 46% of total revenue across all chains.

- In April of this year, Solana’s DEX volume rose to $1.887 billion in a single day, which is more than Ethereum’s $1.182 billion on the same date.

- CoinGecko recently noted in a tweet that Solana led all blockchains in DEX revenue for the first quarter, after capturing nearly 40% of the total volume.

Despite the market’s sluggish performance and lack of volatility over the last few weeks, Solana has managed to stay ahead of the curve in terms of utility.

Despite a brutal 90% decline in memecoin activity on the platform, SOL has managed to stand its ground in terms of blockchain revenue.

This proves again that Solana is more than a haven for memecoin-focused speculation and sets $SOL up nicely for a major price move in the medium to long term.

Here’s how SOL has maintained its strong position among other chains and what could be driving its success.

What does the future hold for Solana, now that the memecoin craze has faded?

From Memecoin Madness to Organic Growth

Last year saw Solana ride the speculation wave better than any other network.

The network saw the creation of the memecoin tool, Pump.fun, along with the rash of celebrity memecoin scams that followed.

Later along the line, it saw the launch of more memecoins tied to political figures like Donald and Melania Trump, as well as the infamous LIBRA, which crashed bitterly and wiped billions off the board.

This speculative frenzy that lasted for more than a year pushed SOL’s DEX volumes and transactions to record highs.

However, the hype didn’t last forever.

By the start of the year, the hype had already begun to cool off, even despite the $TRUMP and $MELANIA tokens in January.

According to data from Blockworks and Syndica, memecoin activity on the SOL network has fallen by over 80% from its peak.

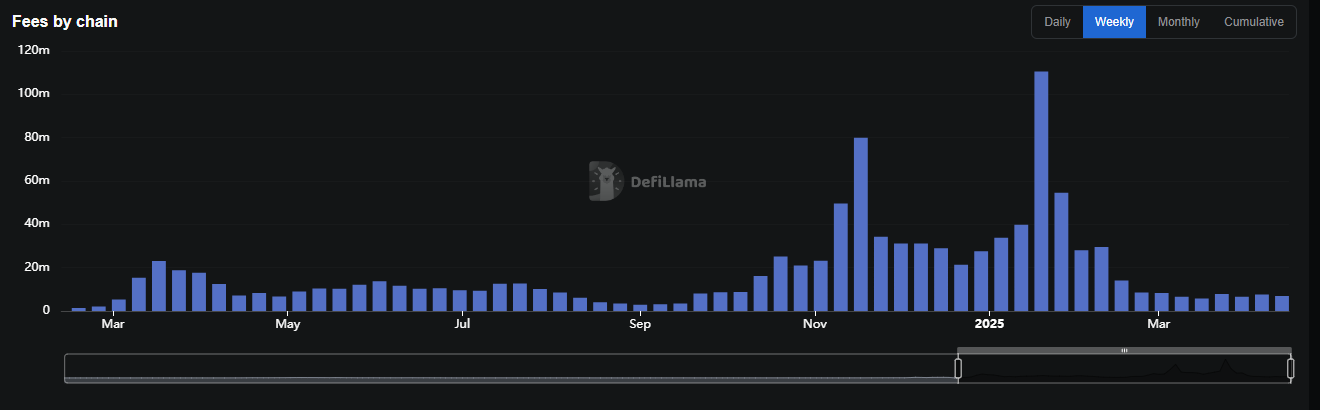

Revenue from transaction fees has also dropped strongly, with DeFiLlama data showing a major plunge from nearly $18 million per day in January to under $470,000 by mid-March.

Solana Still Leads in On-Chain Revenue

Despite the decline, Solana is still leading on most metrics that matter.

In terms of total blockchain revenue, March has seen Solana Dapps account for up to 46% of total revenue across all chains.

More recently, this figure has risen to over 70%, showing that its application layer is now more resilient than ever, despite the memecoin space losing steam.

This shift in revenue sources shows that users are engaging more with DeFi protocols and NFT platforms rather than chasing short-term trends with the memecoins.

DEX Volumes Point to More Adoption

Another sign that SOL has some serious staying power is in its strong DeFi sector.

In April of this year, Solana’s DEX volume rose to $1.887 billion in a single day, which is more than Ethereum’s $1.182 billion on the same date.

This means that Solana is leading the charge in the ongoing battle for DeFi dominance.

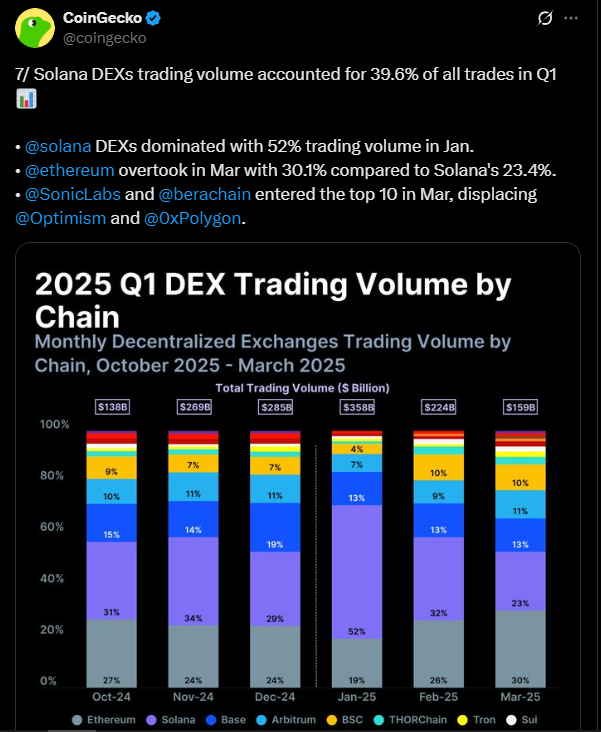

CoinGecko recently noted in a tweet that SOL led all blockchains in DEX revenue for the first quarter, after capturing nearly 40% of the total volume.

Even more impressive was the network’s performance in January, when Solana claimed up to 52% of all DEX volume.

While February saw a dip and Ethereum briefly claiming the top spot, Solana bounced back and by mid-April was recording daily volumes above $2.5 billion.

In essence, Solana now rivals Ethereum once again.

Solana Dominates the Stablecoin Space

As the risky tokens lost appeal, stablecoins stepped into the light with SOL at its helm.

At the time of writing, SOL’s stablecoin market cap has reached a new all-time high of $12.73 billion.

This growth has been important because stablecoins offer utility across several use cases, from lending to borrowing and trading.

Investors particularly favor them because they offer an escape from the volatility of regular cryptocurrencies.

Even though the network fees and revenues have dropped, the rise in stablecoin liquidity shows that users are actively deploying capital within the SOL network.

This is especially important for a market that is becoming more and more cautious.

Why Memecoin’s Decline Might Be a Blessing

It might be tempting to see the memecoin decline as a setback for the Solana network.

This is especially considering how they were responsible for its major price comeback from last year.

However, the loss of interest in memecoins might be a healthy reset, and here’s why.

To start with, investors relying too much on hype-driven tokens made SOL especially volatile in terms of price and network activity.

Now, with the decline in interest and users shifting towards more stable applications of blockchain, Solana has an opportunity to build a more mature ecosystem.

The ongoing dominance in DEX volume and stablecoin dominance (without the help of memecoins) shows that SOL is growing past the pump-and-dump phase and is becoming more of a serious competitor to Ethereum.

Can Solana Keep the Crown?

Still, the more important question is, can SOL continue to lead if the memecoin craze fails to return?

What happens if Ethereum and other chains (like Sui or Base) introduce something revolutionary and cheap?

One thing to keep in mind is that SOL could lose its dominance if it doesn’t double down on actual utility.

The on-chain revenue of the network has hovered underneath the $500,000 mark in recent weeks, which shows that its transaction activity is weakening.

SOL maxis might want to lookout for any major macroeconomic developments like ETF approvals and so on for a comeback on SOL.

Until then, Solana continues to hover somewhere around the $138 mark and might find it difficult to break above its 100-day simple moving average around $165.