Key Insights

- Ripple’s scheduled unlock of 1 billion XRP on May 1 is turning heads across the crypto market.

- For context, these unlocks occur every month as part of Ripple’s supply management and operation funding.

- XRP has dropped by 2.78% in the 24 hours leading up to the unlock, after falling from around $2.30 to $2.23.

- The U.S. SEC recently delayed its decision on the Franklin Templeton XRP-spot ETF by 45 days.

- Still, these events bring opportunity, and its next move will likely depend on several combinations of factors.

Ripple’s scheduled unlock of 1 billion XRP on May 1 is turning heads across the crypto market.

While this is a recurring event and has gone on for years with Ripple’s escrow system, the timing amid price volatility, ETF speculation and falling user activity has raised some issues about possible sell-side pressure.

Here’s the full picture of what’s happening with XRP and what investors should watch for in May.

1 Billion XRP to Be Unlocked on May 1

Ripple will release 1 billion XRP tokens from escrow in a few hours, all of which will be worth over $2.2 billion at current prices.

For context, these unlocks occur every month as part of Ripple’s supply management and operation funding.

The XRP will be drawn from two dormant wallets, Ripple (26) and Ripple (27), both of which will release 200 million, 300 million and 500 million XRP, respectively.

Historically, Ripple does not use all of the unlocked tokens and re-locks the majority to avoid long-term dilution.

However, the sudden surge in supply from these unlocks tends to create short-term volatility, especially when combined with negative market sentiment.

Price Slips Ahead of Unlock

XRP has dropped by 2.78% in the 24 hours leading up to the unlock, after falling from around $2.30 to $2.23.

The decline comes after a modest rally in April and may be an indicator of market anxiety ahead of the release.

A sell-off would not be uncommon, as previous XRP unlocks have also coincided with short-term sell-offs (especially when other bearish indicators flash warning signs).

Still, unless Ripple does something different from its usual practice of re-locking most of the supply, any effects on price are likely to be temporary.

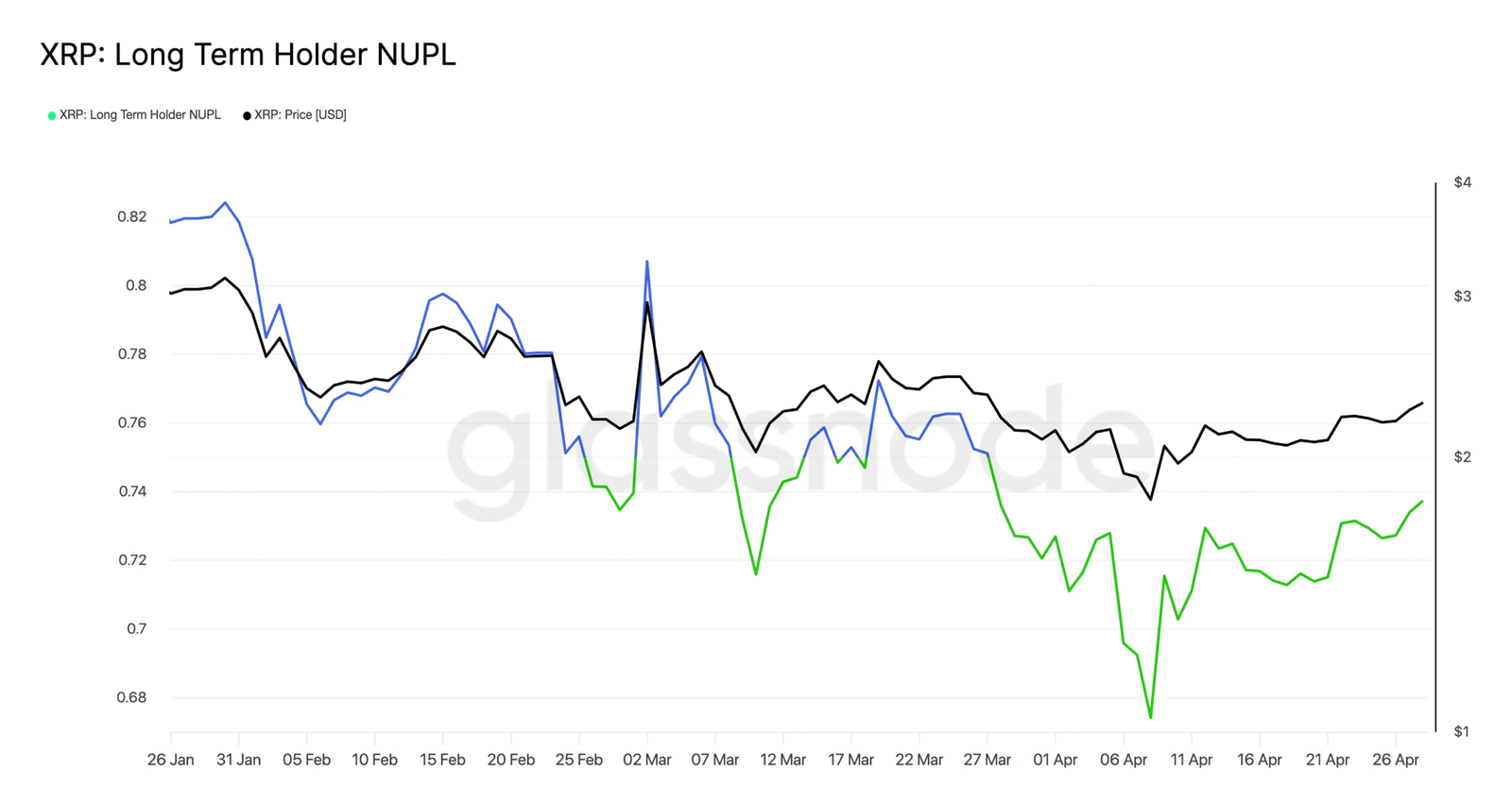

So far, the Net Unrealized Profit/Loss (also known as the NUPL) shows that as of April 29, XRP has a reading of 0.73.

This means that the cryptocurrency is in the “belief–denial” phase.

This range indicates that most holders are still in profit and believe prices could rise. However, skepticism is creeping in.

This reading isn’t necessarily bearish.

A rising NUPL can sometimes show that confidence is growing.

However, without any new catalysts, belief can quickly turn into profit-taking.

ETF Confusion Fuels Volatility

Rumors around a possible spot XRP ETF have also added expectations and confusion to the mix.

ProShares’ XRP Futures ETFs were approved for trading on April 30. However, a true spot ETF has been pending for months.

The U.S. SEC recently delayed its decision on the Franklin Templeton XRP-spot ETF by 45 days.

This has cooled enthusiasm down temporarily, even despite platforms like Polymarket placing a 78% chance on approval by year’s end.

The lack of clarity has damaged investor confidence, and the confusion has been causing unnecessary volatility based on false expectations.

User Activity Drops

Beyond price action and ETF rumors, XRP’s fundamentals are also showing concerning trends.

For example, the number of 7-day active addresses has dropped so far and is now sitting at just 147,000.

This is a strong drop from the March peak of 1.22 million, and the activity dip shows that user engagement is weak.

Without an active network, price growth will become harder to justify.

However, again, low engagement doesn’t necessarily mean a crash is coming.

It does reduce the fuel needed for bullish breakouts though, and a comeback in user participation will be important for any long-term rally.

XRP Price: $3.40 or $1.61?

Market analysts are split on XRP’s outlook in the near term.

If momentum returns, especially through a legit spot ETF approval, XRP could surge to $3.40.

This would be a 49% rally from current levels.

On the flip side, a failure to reclaim its momentum and a break below the $2.00 support level could lead to a drop.

In this case, XRP might revisit the $1.61 level, marking a 29% decline from its current price.

Both scenarios are possible, especially with macro events like U.S. regulatory decisions and the general crypto market trend controlling XRP’s direction.

Catalysts to Watch in May

Some major events that could influence XRP’s performance in the coming weeks include Ripple’s Unlock Strategy, of course.

How much of the unlocked XRP Ripple chooses to sell (or relock) will be a direct indicator of what happens in the short term.

Another one to watch is the ETF Developments.

Any updates from the SEC concerning spot ETF applications, especially from major asset managers like Franklin Templeton or BlackRock, could be market movers.

A rebound in active addresses would also point towards a recovery of interest in XRP and support a bullish outlook.

As always, BTC’s market movements tend to push or pull the entire crypto space with it.

This could be important for what happens to many altcoins, including XRP.

In Total…

Ripple’s monthly unlocks are nothing new; however, they become more powerful market indicators when sentiment is fragile.

Prices are already dipping, and on-chain metrics are showing warning signs. As such, XRP could be in for a volatile start to May.

Still, this volatility brings opportunity.

A spot ETF approval, stronger user participation or favorable market trends could quickly reverse the current narrative.

For now, XRP is worth watching closely, and its next move will likely depend on several combinations of factors.