Key Insights

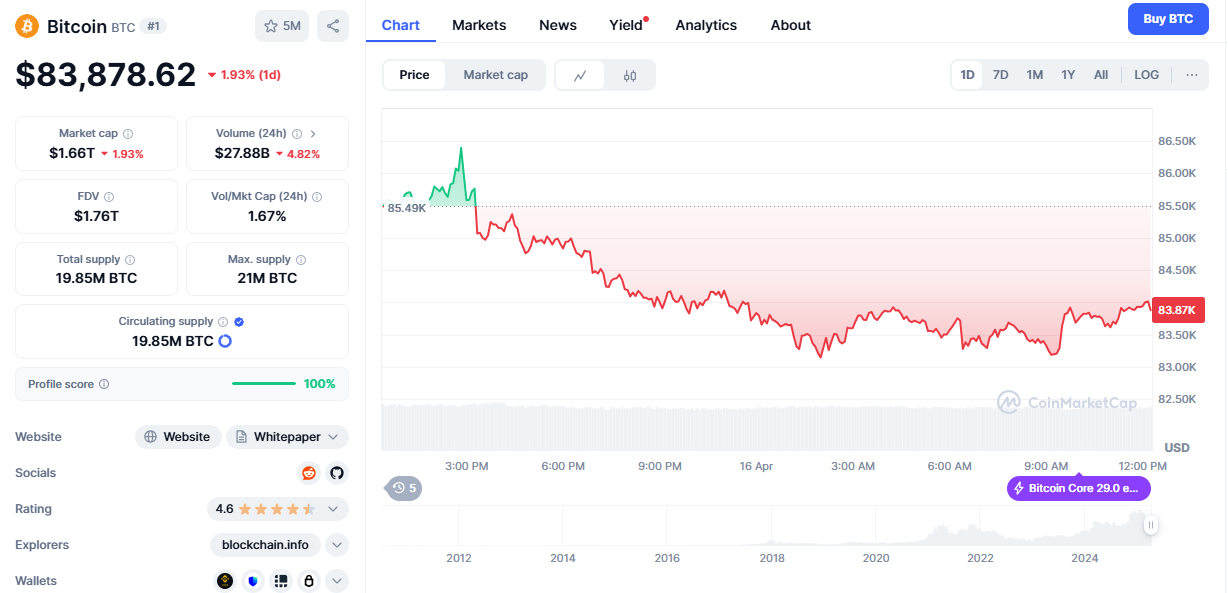

- Bitcoin continues to stall underneath the $85,000 zone as investors continue to express fear over what comes next.

- The number of active Bitcoin addresses is at a two-month low, meaning that fewer people are moving their coins around.

- The charts show that a successful break above $85,000 could trigger a relief rally and lead to the next resistance level around $87,344.

- According to Coinbase’s metrics, the bull market indeed ended in late February, which agrees with an earlier update from CryptoQuant CEO Ki Young Ju.

- Markus Thielen believes that the market is entering “an extended consolidation phase.”

Bitcoin continues to stall underneath the $85,000 zone as investors continue to express fear over what comes next.

So far, the performance of the flagship cryptocurrency has become more than mere price sluggishness.

It now shows the general market mood, which is defined by fear and changing investor strategies, not to mention the macroeconomic uncertainty from the Trump Tariffs.

Bitcoin has now spent months underneath the $85,000 resistance level, and both long- and short-term investors are rethinking their positions.

What could be next for the flagship cryptocurrency?

Bitcoin Price: The $85,000 Wall

The last few months have seen Bitcoin struggle to break above the $85,000 resistance mark. $84,000 price level after failing to end its sideways movement.

This $85,000 zone is more than a mere number on a chart. Instead, it shows that the market is uncertain, and the continued rejections from this price level show that the bulls might be running out of momentum.

The bears might take this development as an opportunity to re-enter the market and take control of things.

Investors are also increasingly cautious. For example, the Fear and Greed Index shows that sentiment has been stuck in the fear zone since early March.

This mood means that not only are new investors shying away from the market, but existing ones are not encouraged to take more risk.

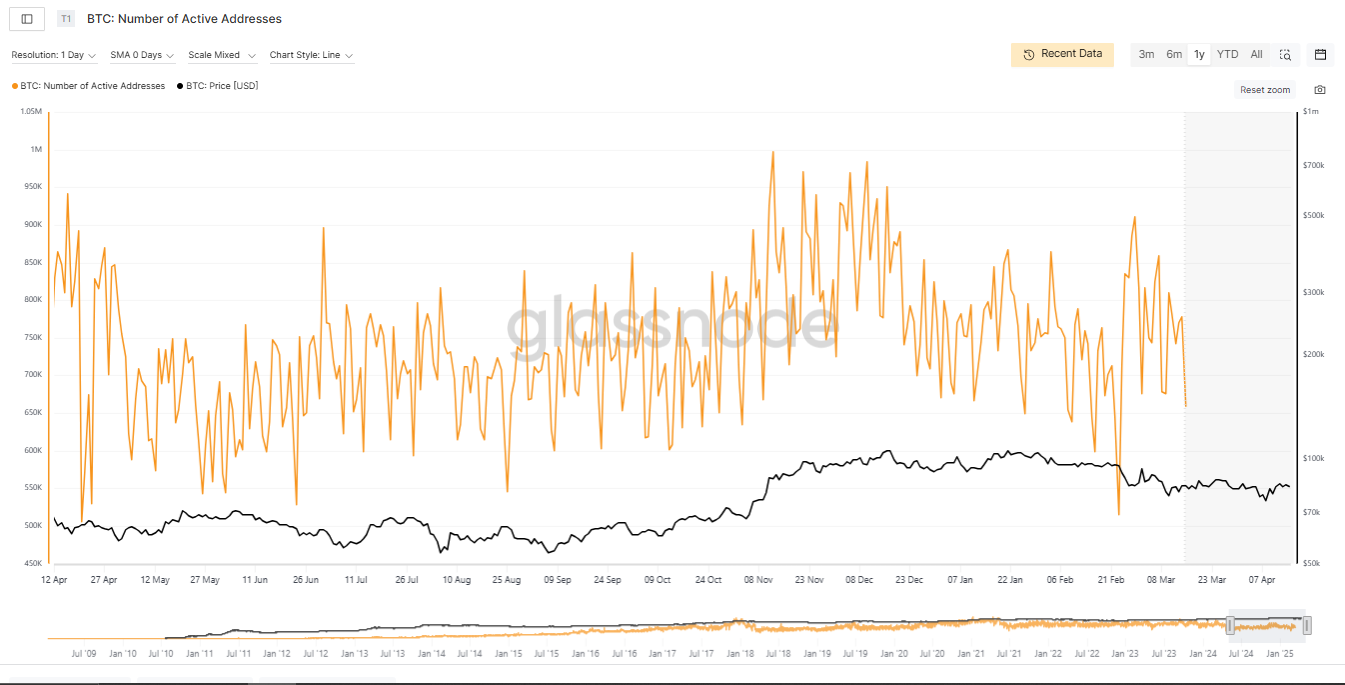

On-Chain Activity Slows as Holders Pull Back

One of the most obvious signs of investor hesitation comes from on-chain data.

In this regard, the number of active Bitcoin addresses is at a two-month low.

This means that fewer people are moving their coins around in transactions or other forms of trading activity.

This drop-off is concerning because, from a historical perspective, they often lead to consolidations or heavy crashes if the bulls fail to enter the market.

When users disengage with the market, it shows that there is a problem of confidence in short-term gains.

In essence, many investors sitting on the sidelines and waiting for clear indicators that it is safe to jump back in.

What the Technicals Say

From a technical perspective, Bitcoin is still in the downtrend from January’s post-election pump.

The $85,000 zone now stands as a major ceiling for the cryptocurrency’s price, and a failure to break above this barrier could lead to a retest of $82,619.

If this price level does not hold as well, then Bitcoin could be in for a dip towards $78,481 or even lower.

However, the picture isn’t entirely gloomy. The charts also show that a successful break above $85,000 could trigger a relief rally and lead to the next resistance level around $87,344.

If the bulls step in from there, Bitcoin could be headed towards $89,800, which would point towards a bullish comeback.

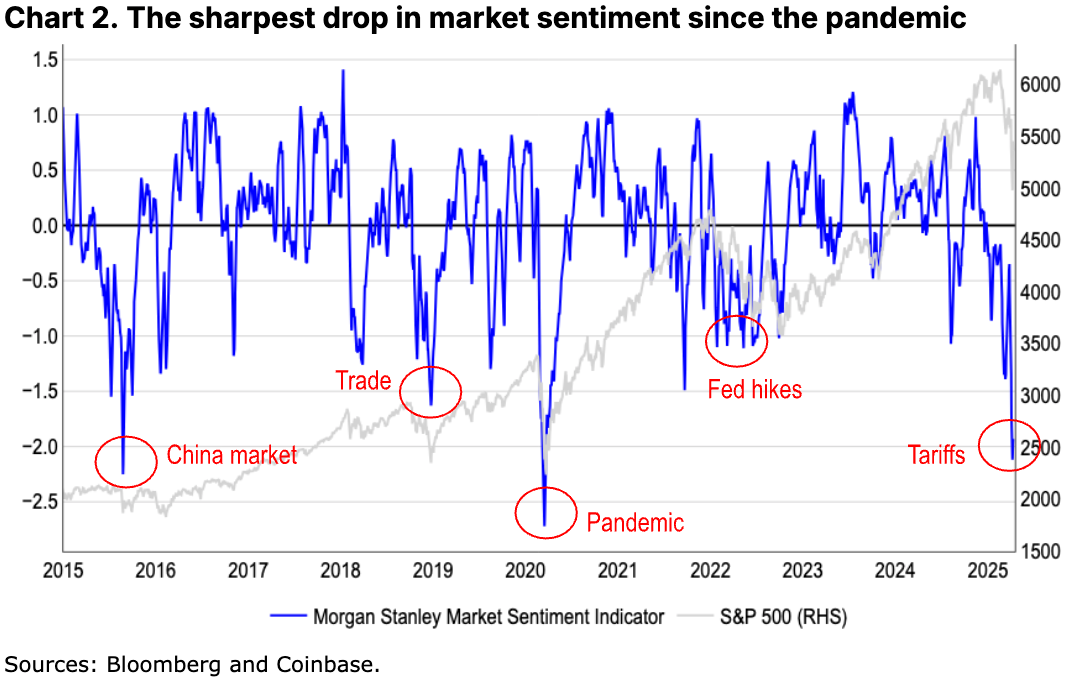

Crypto Market Faces More Headwinds

Bitcoin’s struggles aren’t happening in isolation. According to a recent market review from Coinbase, the entire sector is currently in the middle of a so-called contraction phase.

The report notes that the altcoin market cap has dropped by 41% since December of last year, down from $1.6 trillion to under $1 trillion as of April this year.

Venture capitalists also seem to have lost all interest in crypto, with investments in this sector drying up by as much as 60% compared to 2021–22 levels.

This environment is a disturbing one for risk assets like crypto, where investors seem reluctant to invest fresh capital into the sector because of economic uncertainty.

The ongoing predicament has led to a shrink for the entire sector, with altcoins suffering the worst of it.

Are We Entering a New Crypto Winter?

All of the above begs the question: Is a crypto winter upon us?

According to Coinbase’s report, the answer to this question could be yes.

The firm’s internal models, including its risk-adjusted performance metrics and long-term moving averages, show that the bull market indeed ended in late February, which agrees with an earlier update from CryptoQuant CEO Ki Young Ju.

Since this February crash below $90,000 for Bitcoin, the market has slipped into neutral or even bearish territory.

The 200-day moving average, which is a key metric for market momentum, shows that Bitcoin officially entered bear market territory in late March.

Interestingly, this same model shows that the broader crypto index (known as Coin50) has been in a bear market since February.

Analysts Warn of Extended Consolidation

Adding fuel to the fire, the head of research at 10x Research, Markus Thielen, has taken the opposite stance to analysts, who expect another high by June.

According to the analyst, the market is entering “an extended consolidation phase.”

This means that the most recent rally from Bitcoin wasn’t fueled by retail hype. Rather, it came from long-term investors seeking stability.

He pointed towards indicators like the stochastic oscillator, which shows some similar signals to other market tops in the past.

Thielen believes that Bitcoin’s market behavior is changing, and it is no longer a “long-only” game.

Instead, it is becoming more complex and is more influenced by institutional investment and macroeconomics.

Looking ahead, Thielen expects Bitcoin to range between $73,000 to $94,000 over the next few months.

It is worth noting that this pattern would be similar to ones seen last year, when BTC consolidated for months after hitting a record high of $73,679.

This range, according to Thielen, will remain intact until another political (or macro) event enters the fray and flips the table either bearish or bullish.