Key takeaways

- Bitcoin fell from $88,000 to just above $83,000 after Trump announced sweeping trade tariffs.

- Crypto stocks like MicroStrategy, Coinbase and Robinhood suffered losses across the board.

- Stock markets worldwide reacted negatively to the tariff news, across markets in China, Japan and even Europe

- Analysts warn that a failure to hold above $91,000 could push BTC down to $71,000 or even lower.

- On more positive news, the rising global liquidity, along with Federal Reserve easing could serve as a bullish catalyst.

Bitcoin and the crypto market as whole have experienced sharp declines so far, especially after US president Donald Trump’s latest trade tariff announcements.

The news sent shock waves through the financial markets, with stocks and cryptos experiencing massive losses in after-hours trading.

Investors are now assessing the long-term effects of these policies, and many of them are starting to wonder whether Bitcoin will ever recover, or if further downside is imminent.

Bitcoin Plunges Amid Tariff Fears

Bitcoin crashed strongly, after Trump revealed new reciprocal tariffs targeting some key US trading partners.

The cryptocurrency was trading near the $88,000 zone before the announcement.

However at the time of writing, it is now trading underneath the $83,000 zone once again, and market analysts believe that the cryptocurrency’s increasing vulnerability to macroeconomics could be a major factor in this decline.

Several crypto-related stocks also suffered alongside, with MicroStrategy (MSTR) falling by nearly 10% and COIN losing almost the same amount.

Robinhood (HOOD) also saw around a 9% drop, along with other risk assets like the Nasdaq 100 ETF (QQQ) retreating by around 4% in after-hours trading.

Why Are U.S. Tariffs Affecting Bitcoin?

While the traditional markets have been very volatile as of late, Bitcoin’s reaction to the trade traiffs shows a deeper level of uncertainty among investors.

The most recent data from the Philadelphia Federal Reserve’s Business Outlook Survey (BOS) has fallen below the 15 mark for the first time since the first half of last year.

For context, this metric has historically preceded economic downturns, and could be bad news for crypto as a whole.

According to Charles Edwards from Capriole Investemnts, the Trump tariffs are responsible for shaking investor confidence.

Now, with key economic indicators pointing towards financial stress, Bitcoin has more of a license to decline further.

Bitcoin is now trading near the $80,000 zone and is risking a drop below.

Analysts continue to suggest that the $91,000 zone is a key price point. If a rebound occurs and BTC reclaims this level, it may point towards a strong recovery for the cryptocurrency.

However, a failure to reclaim this price level could lead to a revisit of the $71,000 zone before a rebound of any kind occurs.

Liquidity and Bitcoin’s Price Movement

Despite the short-term bearish outlook, many analysts see a silver lining in the global liquidity and its rising as of late.

Historically speaking, Bitcoin has always benefited from an increase in the M2 money supply.

According to a recent update from market analyst Colin Talks Crypto, a surge in liquidity could create a catalyst for Bitcoin’s next rally.

On the flip side, the timing of this influx is still in question.

Another factor that could influence Bitcoin’s trajectory is the federal reserve’s monetary policy.

The US central bank has already begun easing some of its financial restrictions, in a move that continues to fuel speculation about a possible return to quantitative easing.

Global Market Reactions to Trump’s Tariffs

The stock markets around the world are reacting negatively to the Trump Tariff announcement.

For example, the Nikkei 225 in Japan fell 3%, while Hong Kong’s Hang Seng index dropped 1.5%.

In the US stocks are also dropping steeply, with the Dow futures down 2.39%, S&P 500 futures declining 2.91% and Nasdaq futures falling 3.23%.

The same is true for Europe as well, with London’s FTSE 100 dropping 1.1%, led by losses in banking and mining stocks.

The Trump policy now includes a 25% tariff on auto imports and a minimum 10% tariff on all foreign exports to the U.S. Countries like China and the EU.

Many Chinese goods have seen tariffs rise to as high as 50% and Indian exports now have a 26% increase.

During his announcement, Trump described the move as a step towards economic independence, while declaring 2 April as “Liberation Day.”

Bitcoin Liquidations and Market Sentiment

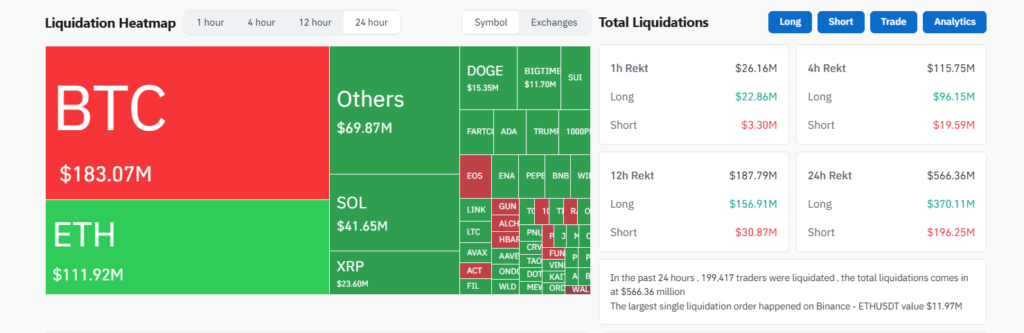

The Bitcoin sell off triggered liquidations across the futures market, with Coinglass data showing nearly half a billion in liquidations across the board.

Ethereum along saw liquidations of nearly $100 million, along with $118 million in Bitcoin short positions.

The sharp movements in Bitcoin’s price also show the increase in risk appetite among traders, despite dampening its role as a hedge against economic uncertainty.

Despite the initial shock from the Tariff announcements, however, some analysts see potential for Bitcoin to recover.

The next few weeks will be important for the cryptocurrency’s price action.

If it manages to reclaim the $91,000 zone, a renewed uptrend could be on the horizon, and Bitcoin could be on its way towards stability.

As the market struggles to digest the recent trends from the US, Bitcoin is likely to remain volatile.

As such, investors must remain cautious and keep an eye on technical indicators that could determine what happens next.

⚠️ Disclaimer: TheCryptoLand is an independent marketing and educational platform, not a financial advisory service. Any content shared, hosted, or expressed by The Crypto Land is for informational purposes only and should not be considered financial advice or investment recommendations.