Key Insights

- Ripple Labs and the U.S. SEC are finally ready to close the book on one of the most high-profile legal battles in crypto history.

- $75 million from the previous $125 million penalty, which is currently held in escrow, will be returned to Ripple.

- The injunction issued against Ripple in August 2024 will be dissolved, and both parties will drop their appeals after the settlement is finalized.

- According to a statement from Commissioner Caroline Crenshaw, this settlement should not be celebrated, as it undermines the agency’s authority.

- Overall, only time can tell whether or not this development leads to growth for the crypto space or ends up as Crenshaw predicts.

Ripple Labs and the U.S. Securities and Exchange Commission (SEC) are finally ready to close the book on one of the most high-profile legal battles in crypto history.

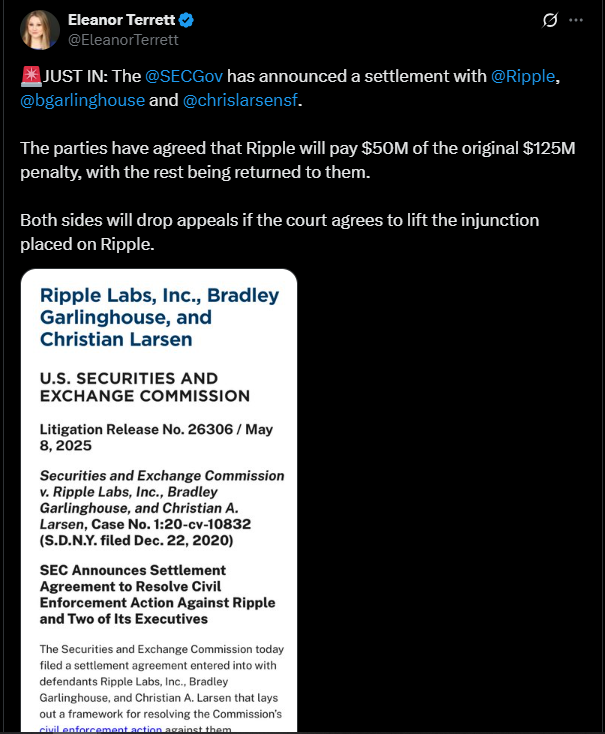

Both parties filed a joint settlement request on 8 May, proposing a $50 million penalty for Ripple.

This marks a massive reduction from the original $2 billion the SEC demanded.

While the court has yet to formally approve the agreement, this development shows that real change is in-bound for the crypto industry indeed.

A Settlement Four Years in the Making

The SEC first sued Ripple in December 2020, accusing the company of raising $1.3 billion through unregistered securities sales of its XRP token to institutional investors. This lawsuit triggered what would eventually become a multi-year courtroom battle that shook the crypto space.

In 2023, U.S. District Judge Analisa Torres ruled that Ripple did indeed violate securities laws when selling XRP to institutional clients.

However, she found that the company had not broken the law by listing XRP on exchanges for retail buyers.

As a result, Ripple was fined $125 million, which was a much lower penalty than the SEC’s original $2 billion demand.

This mixed ruling led to appeals from both sides. Ripple cross-appealed the institutional sales ruling, while the SEC appealed the part that cleared XRP’s retail sales.

Both of these appeals have now been dropped as part of the settlement and are awaiting approval from Judge Torres.

The Terms of the Settlement

Under the terms submitted to the Southern District of New York, Ripple is expected to pay the SEC $50 million.

In addition, $75 million from the previous $125 million penalty, which is currently held in escrow, will be returned to Ripple.

The injunction issued against Ripple in August 2024 will be dissolved, and both parties will drop their appeals after the settlement is finalized.

The agreement also clears Ripple’s CEO Brad Garlinghouse and Executive Chairman Chris Larsen of any remaining charges.

According to legal analysts, before the case can be closed, Judge Torres must issue an “indicative ruling” approving the deal.

Once that happens, the case can be remanded from the Second Circuit Court of Appeals back to her jurisdiction for official closure.

Regulatory Winds Shift Under Trump Administration

This settlement is more than just a courtroom resolution. It shows general change in how the U.S. government is handling crypto regulation.

Since Donald Trump’s return to the presidency in January, his administration has taken a noticeably gentler approach to the crypto sector.

He appointed crypto-friendly Paul Atkins as SEC Chair to replace Gary Gensler, who was known for being aggressive towards crypto during the Biden administration.

Under Atkins, the SEC has dropped multiple lawsuits against blockchain firms.

Trump has also made it clear that he wants to set up the U.S. as a hub for crypto innovation.

The recent Ripple settlement is a major part of this goal, and further shows that the US government is ready to lay back on its harsh regulatory approach towards the crypto sector.

XRP Reacts Amid Marketwide Reactions

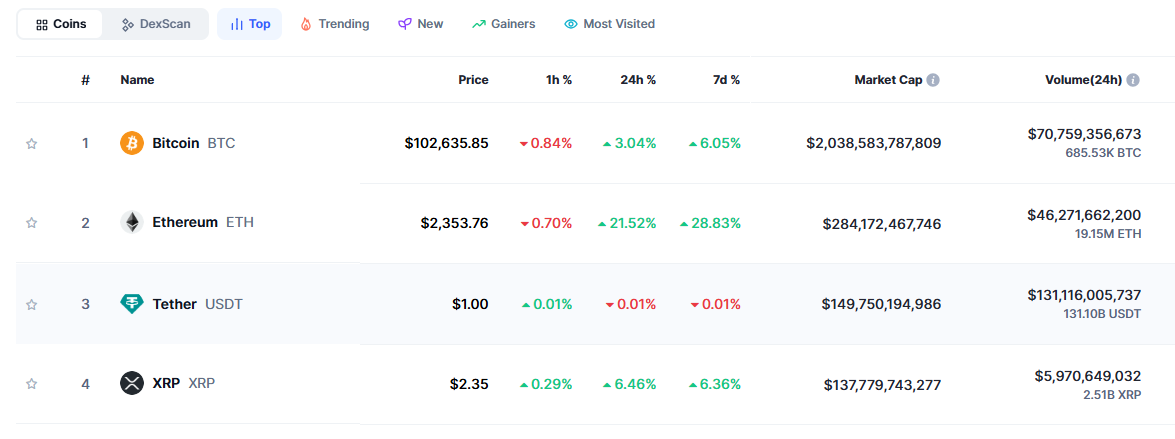

Investors welcomed the settlement news, with XRP jumping 8% to $2.30 after the announcement, according to CoinMarketCap.

The token has climbed over 9% in the last 24 hours, as traders seem to be interpreting this news as a major win for Ripple and crypto at large.

At the time of writing, XRP is the fourth-largest cryptocurrency with a market cap of more than $132 billion.

Analysts believe that the resolution of this lawsuit could be the clarity that Ripple needs to draw in new institutional and retail interest for XRP.

However, not everyone within the SEC is celebrating the deal.

According to a statement from Commissioner Caroline Crenshaw, this settlement should not be celebrated, as it undermines the agency’s authority.

Crenshaw’s term officially ended in 2024. However, the commissioner remains active under an extension and is now warning that this agreement effectively walks back the agency’s previous enforcement win and creates a “regulatory vacuum.”

“This settlement, alongside the programmatic disassembly of the SEC’s crypto enforcement program, does a tremendous disservice to the investing public.” she stated “It creates more questions than answers.”

Ripple’s Position Strengthened

For Ripple, this recent development is a clear win.

Not only has the company avoided the crushing $2 billion fine the SEC originally demanded, but it also gets back most of the funds it was ordered to pay in 2023.

Moreover, Garlinghouse and Larsen being let off the hook has removed a major cloud hanging over the company’s leadership.

With the lawsuit coming closer to being in the past, Ripple can now focus its energy on expanding across borders with XRP and its stablecoin development.

This case might become a major example for future occurrences in how crypto projects are treated by U.S. regulators.

The SEC pulling back on crypto enforcement under new leadership shows that it is indeed taking a more cooperative path to compliance.

Still, Crenshaw’s warnings show that the lack of a clear regulatory framework is still a concern.

While this settlement has given Ripple some breathing room, the crypto industry is still in a gray zone as a whole.

The Ripple-SEC settlement stands as more than the mere end of a legal dispute.

It shows that the tides are changing (or may have even changed completely) when it comes to U.S. crypto regulation.

While this development has been a win for US crypto innovation, others worry that it weakens investor protection.

Overall, only time can tell whether or not this development leads to growth for the crypto space or ends up as Crenshaw predicts.