Key Insights

- Recently, Mike Novogratz pointed out that stablecoins will replace the foreign exchange market in a few years.

- A recent GPS report from Citibank predicts that stablecoin issuers could become some of the largest holders of U.S. Treasuries.

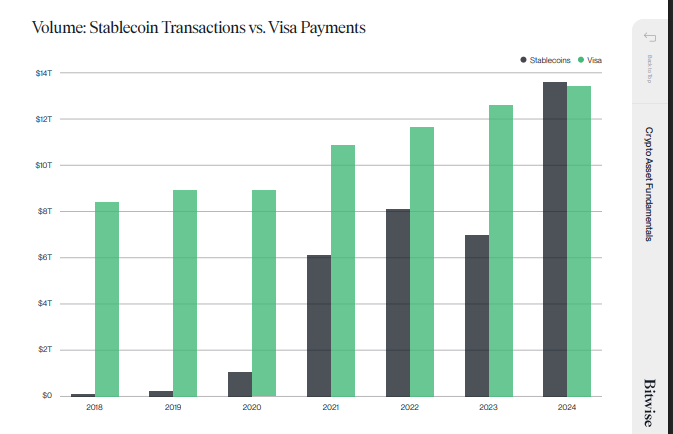

- According to a recent Bitwise report, stablecoin volumes are starting to outshine Visa’s annual volumes in 2024.

- Another pointer to the sector’s maturity is how Stripe recently announced plans to launch its own stablecoin-based product.

- The stablecoin revolution is no longer something to watch from the sidelines. It is already here, and spectators can either fall in or fall behind.

Stablecoins are playing more and more of a major role in the financial space. This fact has held even truer over the last two years, with the steady growth of the Stablecoin market, the US trashing its plans for a CBDC and the emergence of Donald Trump as the US president in November of last year.

Recently, Galaxy Digital CEO Mike Novogratz pointed out that the change could be much bigger and even faster than many expect.

This forecast is backed by the sector’s growing transaction volumes and its institutional interest, not to mention how quickly stablecoin initiatives are advancing all around the world.

Here’s a closer look at what’s happening with the stablecoin sector and why the next five years could be bigger for this aspect of the crypto market.

Traditional FX Faces Big Challenges

The foreign exchange market has been a pillar of global trade and finance for a long time now.

However, it does suffer from a few setbacks, like slow transaction speeds and high costs.

These issues make the sector particularly ripe for disruption.

Stablecoins on the other hand, run on blockchain technology and have near-instant settlement, not to mention lower fees.

This means that they offer a better alternative to many traditional financial sectors with their speeds and 24/7 availability.

Novogratz pointed out in a recent tweet that stablecoins will replace the foreign exchange market in a few years, and countries that fail to adapt to this shift risk being left behind.

“If countries want to participate, they better get on the bandwagon or be left behind,” he warned.

The Rise of the Stablecoin Market

Stablecoins have grown over the last few years. This growth has been nothing short of explosive.

In 2020, the market was valued at around $10 billion. By this year, this figure has ballooned to $230 billion, in a 23x increase within five years.

Big players are getting involved in the sector, and Tether remains the leader of the pack.

So far, USDT has a market cap of around $147 billion, while Ripple’s RLUSD stablecoin has gained massive traction with a $300 million market cap within months of launch.

Even Trad-Fi giants like Fidelity are looking towards their own dollar-pegged stablecoins, and the space is set to expand even more over the coming years.

This wave of activity is being supported by major laws, including bills like the STABLE Act and the GENIUS Act, both of which are moving through the U.S. Congress.

If passed, these laws could further cement stablecoins as major parts of global finance.

Citibank Sees Stablecoins as Major Treasury Holders

A recent GPS report from Citibank also made its own prediction.

According to the firm, stablecoin issuers could become some of the largest holders of U.S. Treasuries.

The report predicts that stablecoin supply is set to reach between $1.6 trillion and $3.7 trillion by the end of the decade, depending on how adoption progresses.

If the regulators establish a strong framework, stablecoin issuers will likely be required to hold safe and liquid assets like treasuries.

This could drive more than $1 trillion in new demand for government bonds.

The report also hints that 2025 could be a major year for blockchain adoption, comparing it to a so called ‘ChatGPT moment’.

A more supportive regulatory environment (especially after the leadership changes at the SEC) could unleash a wave of both the finance and public service spaces.

Stablecoin Volumes Surpass Visa

Stablecoins are not just growing. They are starting to overtake traditional payment giants in some areas.

According to a recent Bitwise report, stablecoin volumes are starting to outshine Visa’s annual volumes in 2024.

This achievement shows how quickly stablecoins are becoming a force to be reckoned with in the global finance space.

They offer instant settlement across borders without having to rely on systems like SWIFT.

Stablecoins have become important for decentralized finance over the years and have now become reliable units of account as well as mediums of exchange.

Their dominance is especially impressive, considering how only five years ago, stablecoin volumes were only one-tenth of Visa’s.

This kind of growth has caught the attention of both investors and governments, many of which are now considering the launch of their own stablecoins,

Stripe Joins the Stablecoin Race

Another pointer to the sector’s maturity is how Stripe recently announced plans to launch its own stablecoin-based product.

According to its CEO, Patrick Collison, this move comes after nearly a decade of internal decisions.

While there aren’t many specific details to go on yet, Stripe’s initial rollout will focus on businesses outside the U.S., EU and UK.

The company’s decision to enter the stablecoin market now show how even trad-fi leaders recognize that the shift is inevitable.

Stripe’s involvement lends further credibility to stablecoins, and will likely nudge their adoption further ahead in mainstream commerce.

The Stablecoin Era Is Only Beginning

Stablecoins are becoming more and more popular and are shifting from being a mere niche crypto product to being a monolith in global finance.

Transaction volumes continue to pump, and institutional giants are rushing into the space.

At this point, predictions from figures like Mike Novogratz no longer seem like fiction.

If the ongoing trend continues, Stablecoins could shape not just foreign exchange, but also the financial systems around the world as well.

However, their long-term success will depend on proactive regulation and maintaining user trust.

The next five years will be important for the sector, governments, businesses and investors alike.

The stablecoin revolution is no longer something to watch from the sidelines. It is already here, and spectators can either fall in or fall behind.