Key Insights

- Staking refers to locking up your crypto through a network’s validators to help keep it running.

- The more you stake, the more your validator manages to accumulate, and the more likely they are to be chosen.

- Staking SOL makes sure that you receive regular rewards for your stake without needing to trade or actively manage your holdings.

- One of the safest ways to stake your SOL is through a non-custodial wallet like Phantom

- By understanding how staking works and following best practices, you’re one step away from earning passive income within the Solana network.

Staking is one of the easiest ways to earn passive income in the crypto space. This process is even simpler when done with networks like Solana.

This process isn’t just about growing your portfolio; it’s also about playing a direct part in keeping the Solana network secure.

If you hold SOL and have it sitting in your wallet, it might be time to put it to work for you.

Here’s everything you need to understand about staking and how you can get started using a non-custodial wallet like Phantom.

What is Staking?

In basic terms, staking refers to locking up your crypto through a network’s validators to help keep it running.

Solana offers staking rewards to users who participate in this process, in the form of new SOL tokens.

Keep in mind that this process is possible through the network’s Proof-of-Stake (PoS) consensus mechanism.

This means that the validators (who help stake your tokens) are chosen to confirm transactions based on how much SOL they’ve accumulated and staked.

The more you stake, the more your validator manages to accumulate, and the more likely they are to be chosen.

When they are chosen, they (and you, if you delegated tokens to them) receive rewards.

Why Stake Your SOL?

1. Earning Passive Income

Staking SOL makes sure that you receive regular rewards for your stake without needing to trade or actively manage your holdings.

The APY (Annual Percentage Yield) can vary at times. However, it often beats what traditional savings accounts offer.

2. Help Secure the Network

The more SOL you stake, the harder it is for attackers to take down the network as a whole. Your stake strengthens the overall health of the Solana network.

3. Low Barrier to Entry

Unlike earning passive rewards on networks like Bitcoin, staking on Solana does not require expensive hardware or technical expertise. Solana can be staked with a few clicks on a user-friendly wallet.

4. Compounding Rewards

You can earn rewards and stake them alongside your initial investment. This creates a compounding effect that grows your earnings over time.

How to Stake SOL Using a Non-Custodial Wallet

One of the safest ways to stake your SOL is through a non-custodial wallet like Phantom, and here’s how you can get to it:

1. Install and Set Up a Wallet

Head over to the official Phantom wallet website (or any other Solana-compatible wallet like SolFlare or Trust Wallet) from the official source.

Follow the instructions to create a new wallet, and be sure to back up your seed phrase securely.

Remember that it is the only way to recover access if you lose your device.

2. Fund Your Wallet

Once your wallet has been downloaded and set up, transfer some SOL tokens from an exchange (or another wallet) into your Phantom wallet address.

Be sure to remember that you’ll need a small amount of SOL left unstaked to cover transaction fees.

3. Go to the Staking Section

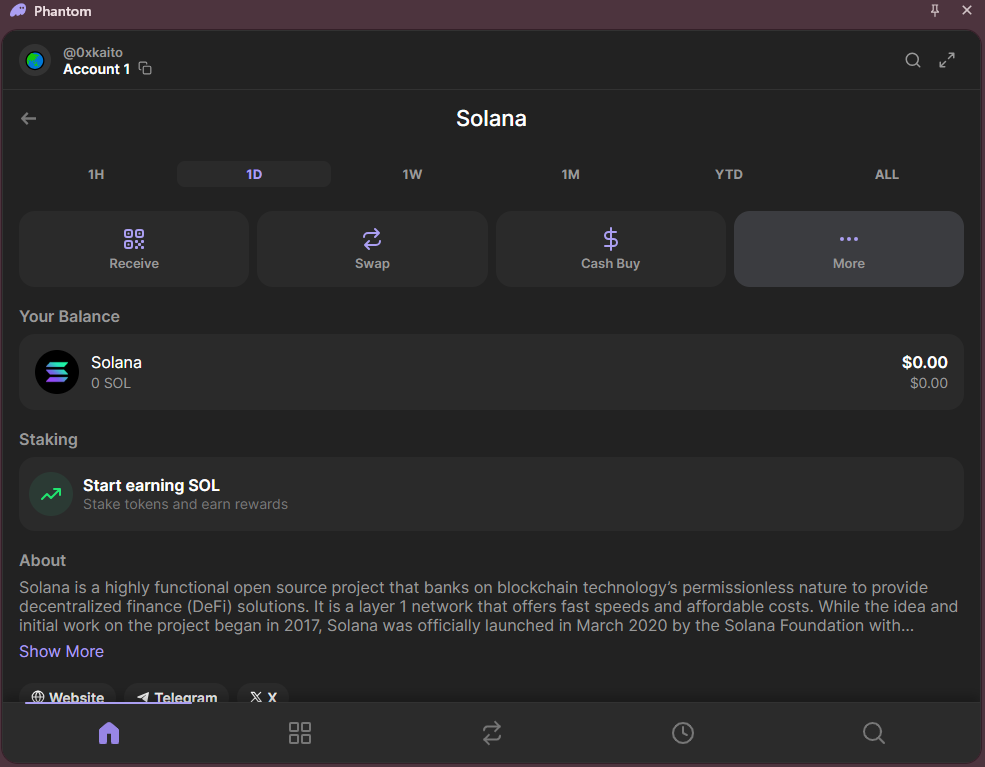

Open the wallet app, click on Solana and find the “more” button. Once that opens, scroll down and find the “Stake” or “Earn.”

This will show you a list of available validators you can delegate to.

4. Choose a Validator

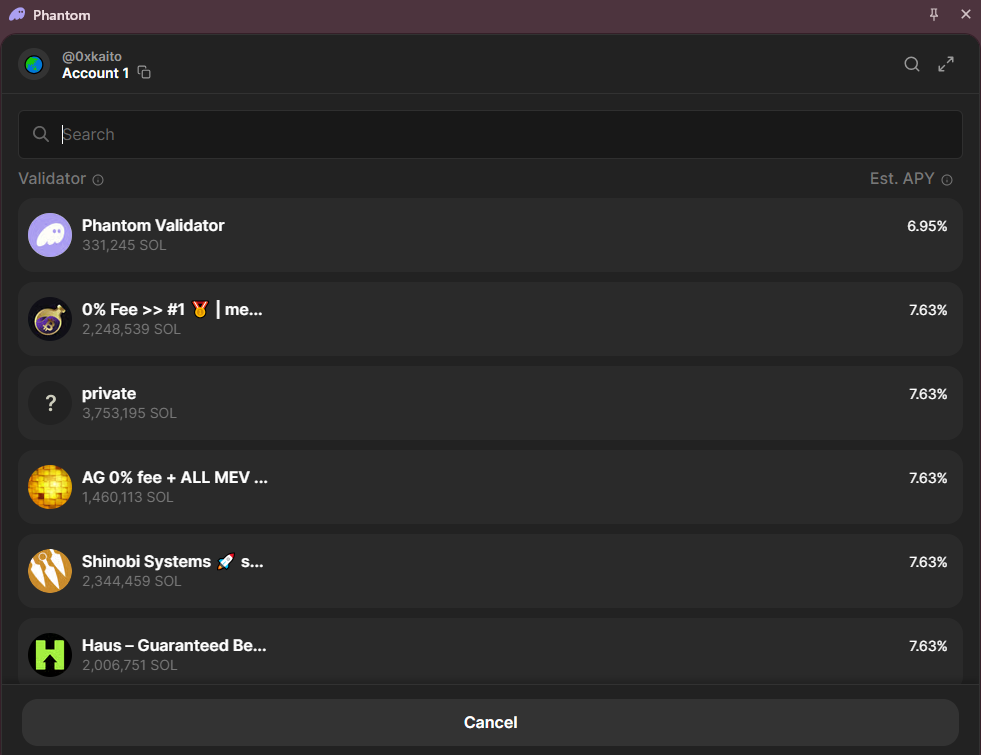

When selecting a validator, be sure to look at factors like uptime, commission and total stake.

In the case of uptime, the more a validator stays online, the more reliable your rewards.

For commissions, remember that validators take a small percentage of your rewards, and lower commission means more earnings for you.

Remember how we said that the more SOL a validator has staked, the more likely they are to be chosen to validate transactions?

You might want to go for a validator with higher amounts of staked SOL. On the other hand, increasingly supporting large validators creates a centralization problem for the network, which can be bad for the long term.

You can choose to support smaller validators to promote decentralization.

Either way, keep the “why” in mind before choosing a validator.

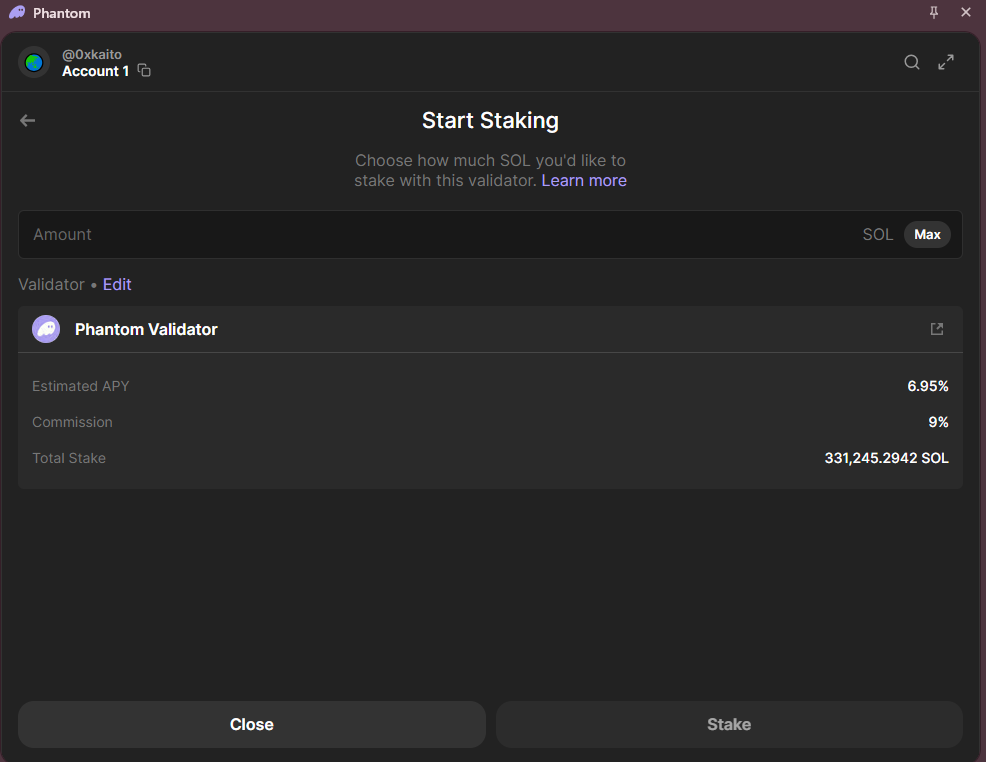

5. Delegate Your SOL

Click on your chosen validator and select “Stake” or “Delegate.” Enter the amount of SOL you want to stake and confirm the transaction.

Remember that you’ll need to approve this with your wallet and pay a small $SOL-based fee.

6. Track Your Rewards

You can monitor your staking performance from within your wallet, as rewards usually start accumulating at the end of the next epoch.

Things to Watch Out For

While staking is relatively safe, some things to keep in mind include validator risk and slashing.

If a validator acts maliciously (or even makes an honest technical error), the network takes a portion of their staked SOL as a penalty in what is known as “slashing”.

While slashing on Solana is rare, it is still a good reason to choose a good validator.

Another thing to remember is that Unstaking Takes Time.

If you decide to unstake at any time, your SOL won’t be immediately available.

You’ll need to wait for one full epoch (about 2-3 days) before you can move your funds again.

If your current validator’s performance drops or they increase their commission, you can redelegate your SOL to a different validator.

However, this will require unstaking first and going through the cool-down period.

Finally, never share your seed phrase or private keys.

Remember to double-check all links and emails before clicking any links, as phishing scams are common in crypto.

Always double-check the official source before downloading wallets or any other software.

By understanding how staking works and following best practices, you’re one step away from earning passive income within the Solana network.