Key Insights

- Bitcoin still being on its way to maturity means that it remains vulnerable to macroeconomic trends.

- The Conference Board’s Leading Economic Index (LEI) for March has been flashing warning signs over the last few months.

- If the manufacturing sector continues to show weakness, it could fuel more fears of an economic downturn.

- Thursday will see the Labor Department report the latest initial jobless claims, which could fuel or dampen investor risk appetite.

- The University of Michigan’s Consumer Sentiment Index is likely the most important one to watch out for this week.

The crypto industry has come a long way over the last decade. However, it is still a long way from maturity compared to more established financial spaces, like the stock market.

Crypto still being on its way to maturity means that it remains vulnerable to macroeconomic trends.

This week, several major US economic indicators are set to go live and affect Bitcoin (and other digital assets) in one way or another.

Here are some of the most important economic data that crypto investors and traders should watch out for over the coming days.

1. Leading Economic Index (LEI)

The first economic data to keep an eye out for this week is The Conference Board’s Leading Economic Index (LEI) for March.

This index was designed to predict future economic activity and has been flashing warning signs over the last few months.

For example, readings from February showed a 0.3% decline, showing that there is an ongoing softness in the economy.

The forecast for March expects another drop, with analysts generally agreeing at around -0.5%.

This predicted decline for the LEI (as mentioned) points towards a slowdown in economic activity.

Bitcoin could experience this decline in one of two ways.

For starters, a weaker economy tends to push investors away from risk assets like crypto and towards safer assets.

On the other hand, fears about traditional financial systems can become harsher with a weaker LEI and could reinforce the “Bitcoin as digital gold” narrative.

If the LEI continues to fall, Bitcoin will be open to some more downward pressure unless a new narrative emerges in favor of crypto.

2. Services PMI

The S&P Global U.S. Services Purchasing Managers Index (PMI) rose to 54.4 in March.

This increase came from readings of 51.0 the month before.

As it stands, any reading above the 50 mark shows economic expansion and that the US economy is getting stronger.

If this index continues to rise, it could strengthen the U.S. dollar and reduce the likelihood of near-term rate cuts by the Federal Reserve.

These outcomes would typically put some bullish pressure on Bitcoin, which typically suffers when the dollar is strong.

However, strong services data could also make investors more hungry for risk, which could be bullish considering Bitcoin’s ongoing correlation with tech stocks.

This being said, if inflation fears resurface alongside the positive PMI data, Bitcoin could be in for some more selling pressure.

3. Manufacturing PMI

While services are booming, the manufacturing industry tells a different story.

For example, the March S&P Global U.S. Manufacturing PMI dipped to 50.2, just above the line between growth and contraction.

Even more concerning was the ISM Manufacturing PMI, which fell to 49.0 and shows weakness in the sector.

Why does the Manufacturing PMI matter?

Manufacturing is a major economic indicator, especially when global demand remains shaky and trade tensions are rising.

If this sector continues to show weakness, it could fuel more fears of an economic downturn.

Soft manufacturing data weakens investor appetite for risk assets like crypto.

While on one hand, a weaker manufacturing PMI could open the door to rate cuts from the FED, the inflation (and a possible comeback of the Trump tariffs) may limit any dovish tilt from the Fed.

Overall, this piece of news is slightly bearish for Bitcoin.

4. Initial Jobless Claims

Thursday will see the Labor Department report the latest initial jobless claims.

Last week’s numbers came in at 215,000, which was a slight decline from the previous week’s 223,000.

While this decline is not necessarily bearish, the trend of declines shows that the labor market is cooling.

As such, if new data shows that jobless claims are rising, it could point towards pressure for the US economy and drive investors out of risk assets.

On the other hand, if job losses stay relatively stable and the FED sees this as a sign that the US economy is strong, it could delay more rate cuts and give Bitcoin a chance to boom.

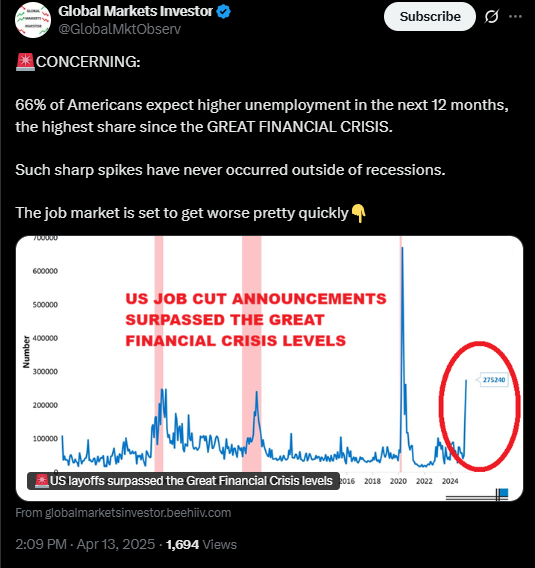

5. Consumer Sentiment

The University of Michigan’s Consumer Sentiment Index is likely the most important one to watch out for this week.

This index hit a historic low of 50.8 in March, which is worse than levels seen during the Great Financial Crisis.

Lower consumer sentiment typically leads to more conservative spending from the average citizen and lower investor sentiment when it comes to risk assets.

If people are generally pessimistic about their finances in the future, they’re less likely to splash money on crypto or NFTs.

However, this sentiment can be a double-edged sword.

If retailers lose faith in traditional financial institutions or fiat, they may start to look towards defi alternatives like crypto.

Still, this would require a massive narrative shift, which doesn’t seem likely to happen soon, from what the market currently shows.

The Macro-Crypto Connection Is Real

Crypto markets don’t operate in a vacuum anymore. Bitcoin is reacting more and more to economic indicators and central bank policy and is dragging the rest of the market along with it.

This week’s data releases could trigger anything from short-term price movements to a total bullish (or bearish) avalanche.

Crypto investors should approach the week with caution, as macro data is a lot more powerful for predicting trends than many realize.

While none of these indicators are enough to cause a full-scale price movement on their own, they form a major force to be reckoned with when combined.

If you are active in the markets, this is a week to stay locked in or to stay away from investments altogether.

Be sure to monitor the data and watch the Fed.